As tensions between China and the United States of America increase, following the Russia-Ukraine crisis, concerns about supply chain fragmentation and security of supply have increased. Although there are analyses of China's dominance of rare earth elements, efforts by the Western Front to reduce Beijing's dominance of these resources have accelerated dramatically in recent years.

Since China's economy has developed a lot in the past few decades, its leaders have always sought to make the country a key player in important strategic industries. In this regard, the Chinese government has tried to introduce this country as the main global supplier of rare earth elements, which include a necessary set of seventeen minerals (the base for the production of military weapons systems, electric vehicles, lasers, smartphones, and countless advanced technologies).

China's superiority in the supply chain of rare earth elements

In the mid-1980s, the Chinese government took great steps to support its fledgling industry in the field of rare earth elements by issuing export tax rebates. These rebates have reduced costs for Chinese mining companies and allowed them to gain a foothold in the global market. From 1985 to 1995, the production of rare minerals in China increased from 8,500 tons to approximately 48,000 tons, and its share in world mineral production increased from 21.4% to 60.1%. In addition, a large percentage of the processing of such elements in the whole world takes place in this country.

As China's mining capacity expands, rare earth element producers in many countries have begun moving their production chains to China to take advantage of the country's lower labor costs and more lenient environmental regulations. However, in 1990, the Chinese government, considering these elements as strategic products, announced that it prohibited foreign companies from mining rare earths in China and limited foreign participation in processing projects of these elements, except in joint ventures with Chinese companies. This gave Chinese companies the space to acquire foreign knowledge through these partnerships while eliminating foreign competition from the supply chain.

In general, the value of global trade in rare earth elements is relatively small compared to other goods. In 2019, the worldwide trade value of this category of elements was only $1.15 billion, which was insignificant compared to the world market of about 1 trillion dollars of crude oil. However, since the production of any electronic product is highly dependent on it, the final total value of goods produced using such earth elements is very high and will have a huge effect on the global trade arena. For example, Apple alone, as one of the manufacturers of electronic products, has earned about 394 billion dollars during the fiscal year 2022.

During the technological conflict between China and the United States, Beijing raised tariffs on the country's rare earth elements (and other products) from 10% to 25%. The previous government in the US under Trump reportedly drew up plans for its own tariffs on Chinese rare earth elements. Still, it never implemented them due to concerns that it would leave US companies without affordable alternative suppliers. Policymakers in the United States are particularly concerned about the risk of supply chain disruptions for the U.S. defense industry, which uses rare earths in a wide range of technologies, from sonar and communications equipment to missiles and jet engines. According to the US Congressional Research Service (CRS), about 427 kilograms of rare earth elements are needed to build each US F-35 multirole fighter, and nearly 4.2 tons of these elements are needed to build each Virginia-class nuclear submarine.

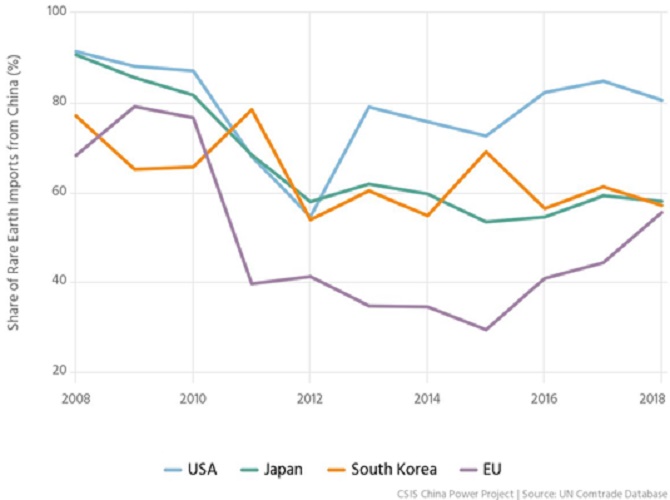

The graph of the dependence of countries on the import of rare earth elements from China

Why is it difficult for other countries to increase production?

Rare earths are relatively abundant, but they are found in low concentrations and usually mixed or with radioactive elements such as uranium and thorium. The chemical properties of such elements make it difficult to separate them from the surrounding elements, and their processing produces toxic waste. China's easier environmental standards have enabled the country to strengthen its dominance in the industry in recent decades as Western manufacturers have moved away from the industry.

According to Western experts, Beijing has shown that it is willing to use its weight in the global industry of rare earth elements to achieve its political goals; therefore, in contrast, Western countries have increased their support to boost domestic production of critical rare earth elements. Recently, Australia, Canada, the European Union, and the United States have set support packages and policies for their critical mineral sectors.

Perspective of the Supply chain of Rare earth elements

In the future, it is expected that the demand for rare earth elements will increase dramatically until 2030 and after, and China will continue to lead in this field. It is interesting to note that China's BYD Company has become one of the top producers of electronic vehicles due to having the complete chain of materials and primary elements necessary for the production of electric vehicle batteries. At the same time, the Tesla Company of America is completely dependent on third parties in this regard.

Along with the statistics of 60% extraction of rare earth elements in China, about 90% of the processing stage of these materials takes place in this country. It seems that the efforts of Western countries and the United States to reduce their dependence on China in this regard will not be successful in the short term due to the risk of disrupting the wide chain of this industry. Likely, these countries will gradually try to diversify their import sources, increase loans to internalize this industry, improve the necessary technologies and train specialized workforce to reduce their dependence.

Despite Western efforts to counter China's dominance of rare resources, China is likely to dominate the supply chain for these elements by 2030. Of course, it is possible that despite the approval of the Inflation Reduction Act in the United States of America and the Critical Minerals Act in the European Union, the years 2022 and 2023 will be a turning point in the commitment of most countries of this front to diversify China's supply chain of rare earth elements. In the story of the trade tariff conflict between the US and China, we also saw that each of these two countries benefited from their advantages as a balancing lever for trade conflicts.

So now, Chinese statesmen are well aware of their strategic superiority and try to use it in the best way to promote their interests while maintaining their position as much as possible and as long as they have the advantage in this field. In this regard, there will be a big competition between Western countries and China in small elements.

Mehdi Salami expert of the IPIS

(The opinions expressed are those of the authors and do not purport to reflect the opinions or views of the IPIS)